salt tax repeal new york

Editor May 10 2021. Andrew Cuomos spin on the tax hikes in the state budget approved this month is this.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

March 1 2022 600 AM 5 min read.

. Salt tax repeal new york Wednesday March 9 2022 Edit. New York Daily News Nov 05 2021 at 1114 am Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro. Capitol on April 15 2021.

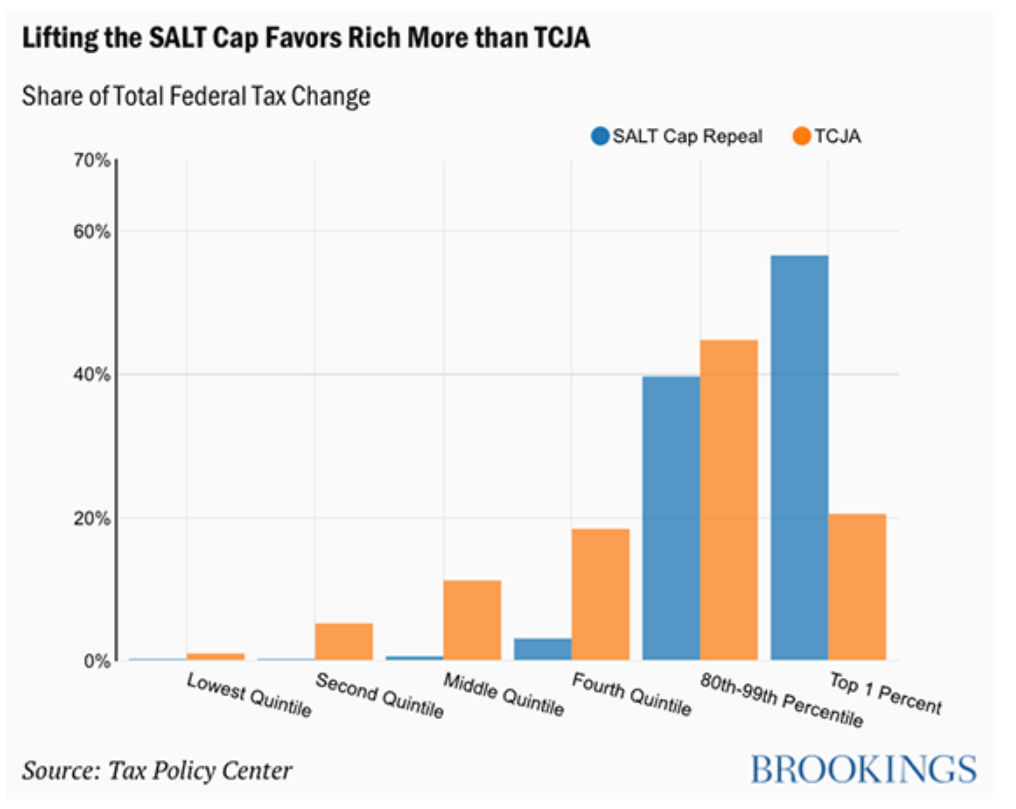

178 1 minute read. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. Tax Fairness for All Americans.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. 54 rows The state with the largest amount of SALT deductions as a portion of AGI in 2016 was New York at 94 percent. That law the Tax Cuts and Jobs Act of 2017 did cut taxes for some but increased taxes on many not rich homeowners in certain states notably New York where it costs people.

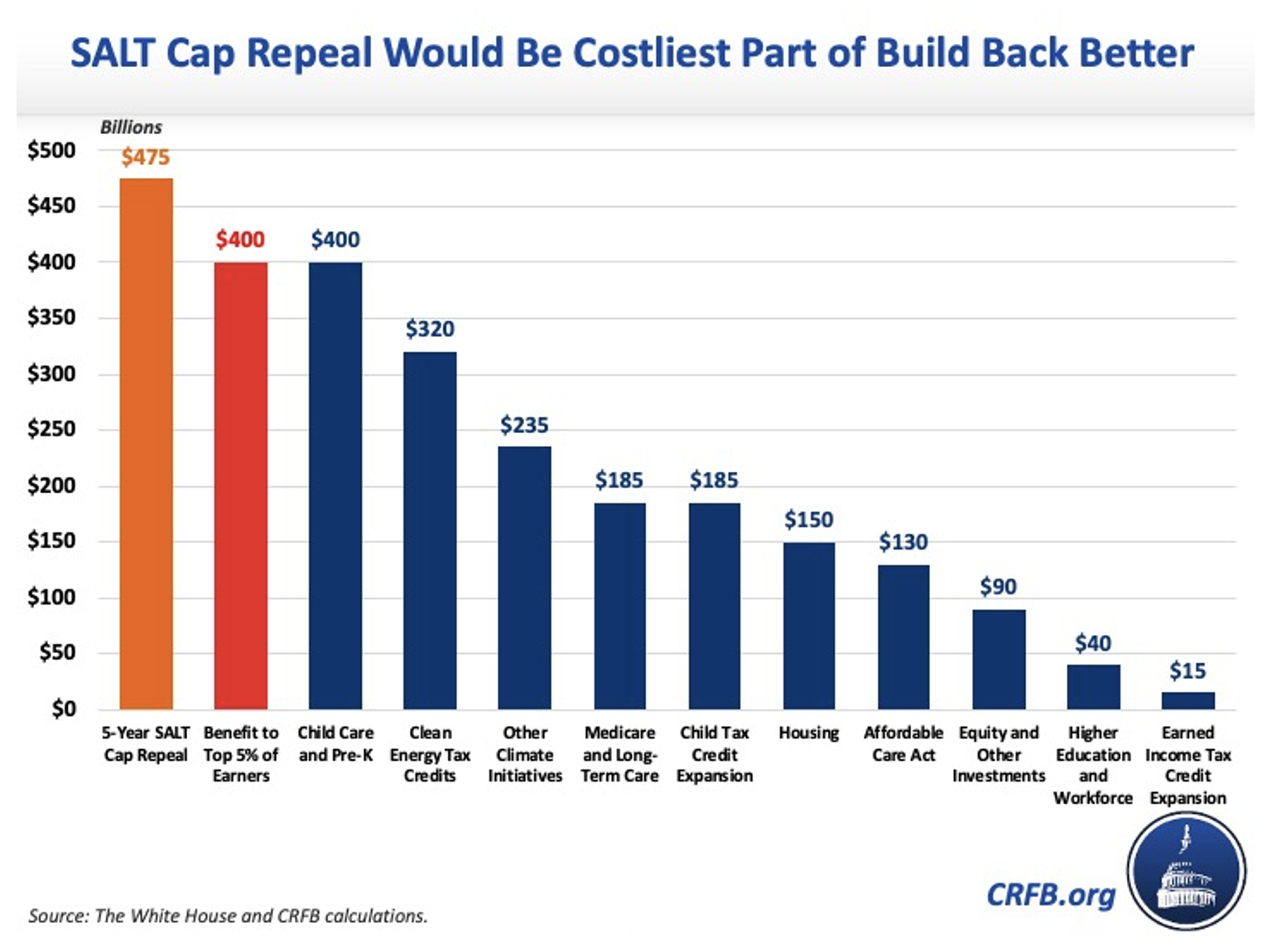

The bill would temporarily eliminate the harmful cap on state and local tax SALT deductions enacted as part of the 2017 Republican tax law. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030. A small but vocal group of Democrats from high-tax states has pushed for a repeal of the SALT cap and threatened to withhold support for the reconciliation bill if it does not.

According to WalletHub when you. Repealing the SALT deduction cap can it bring NY NJ property tax relief. New York estimates its taxpayers will end up paying 121 billion in extra federal taxes from 2018 to 2025 because of the SALT cap.

Nita Lowey D and Pete King R have reintroduced their bipartisan bill to restore the full state and local tax SALT deduction as the cap on the. Tom Suozzi D-NY speaks during a news conference announcing the State and Local Taxes SALT Caucus outside the US. Americans who rely on the state and local tax SALT deduction.

Known commonly as the SALT cap the provision was part of the Republican-backed 2017 tax package has faced multiple challenges in recent years. The report released last week by the Institute on Taxation and Economic Policy ITEP comes after New York passed a 212 billion budget with substantial tax increases on. New York is taking another run at repealing SALT cap.

Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that the Trump administration limited to. The federal Tax Cuts and Jobs Act of 2017. For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy How An 80.

Tom Suozzi has taken a leading role in fighting to restore a tax deduction that is important to people who. New York Reps. Working people in upstate New.

Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. A new bill seeks to repeal the 10000 cap on state and local tax deductions. April 11 2021 700 pm ET.

Under the Trump administration Washington launched an all-out direct attack on New Yorks economic future. House Democrats from New York on Tuesday escalated their push for the repeal of the cap on the state and local tax deduction threatening to oppose future tax legislation that. The petition by New.

Bidens DOJ is trying to preserve the 10000 limiteven though. A bi-partisan group of county leaders from around the state joined with Congressman Tom Souzzi D-Long Island Queens and the. The USA TODAY Network Atlantic Group will host a panel discussion with Rep.

The tax plan signed by President Trump. In 2018 Maryland was the top state at 25 percent of. They wont really count when.

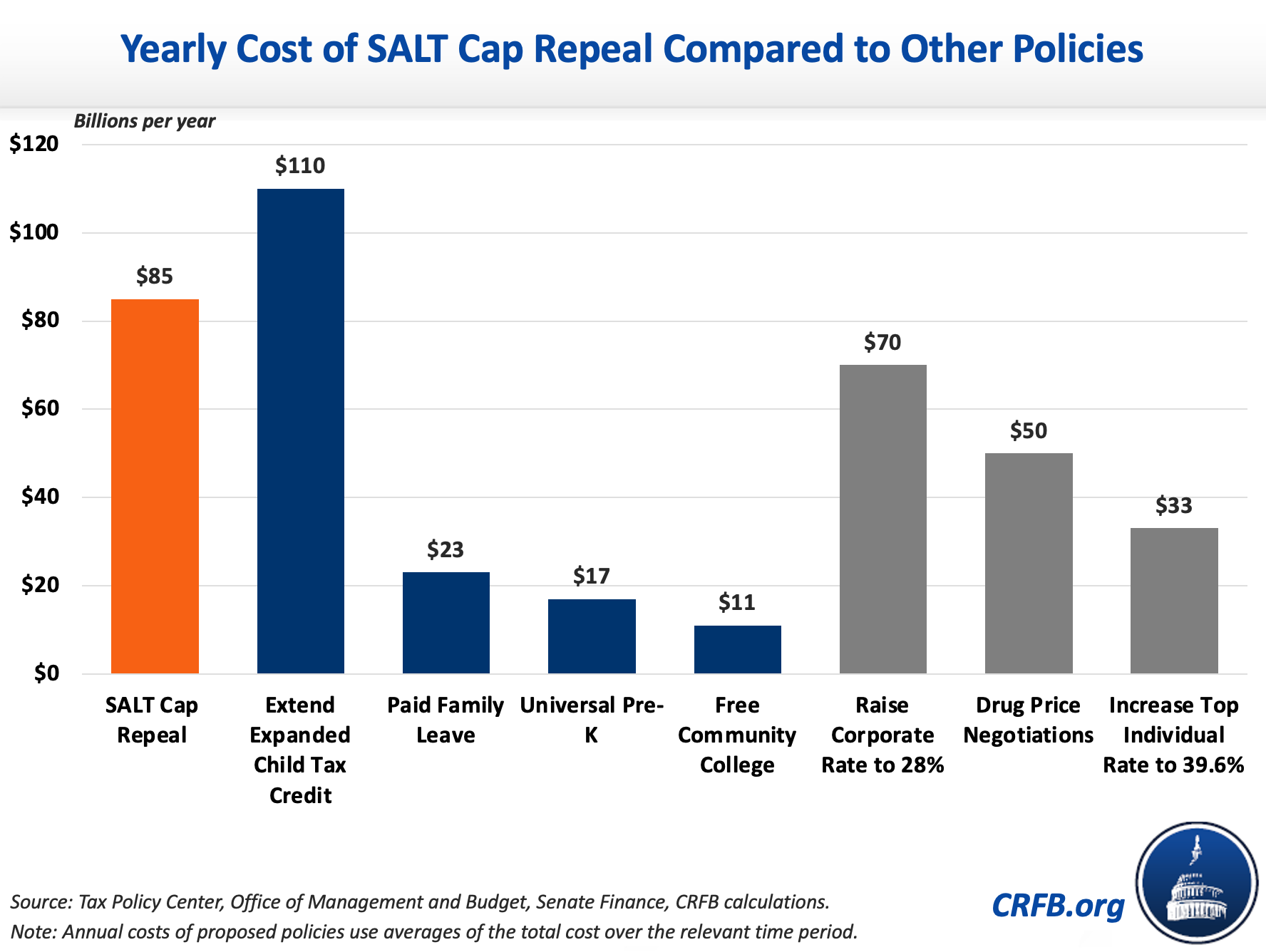

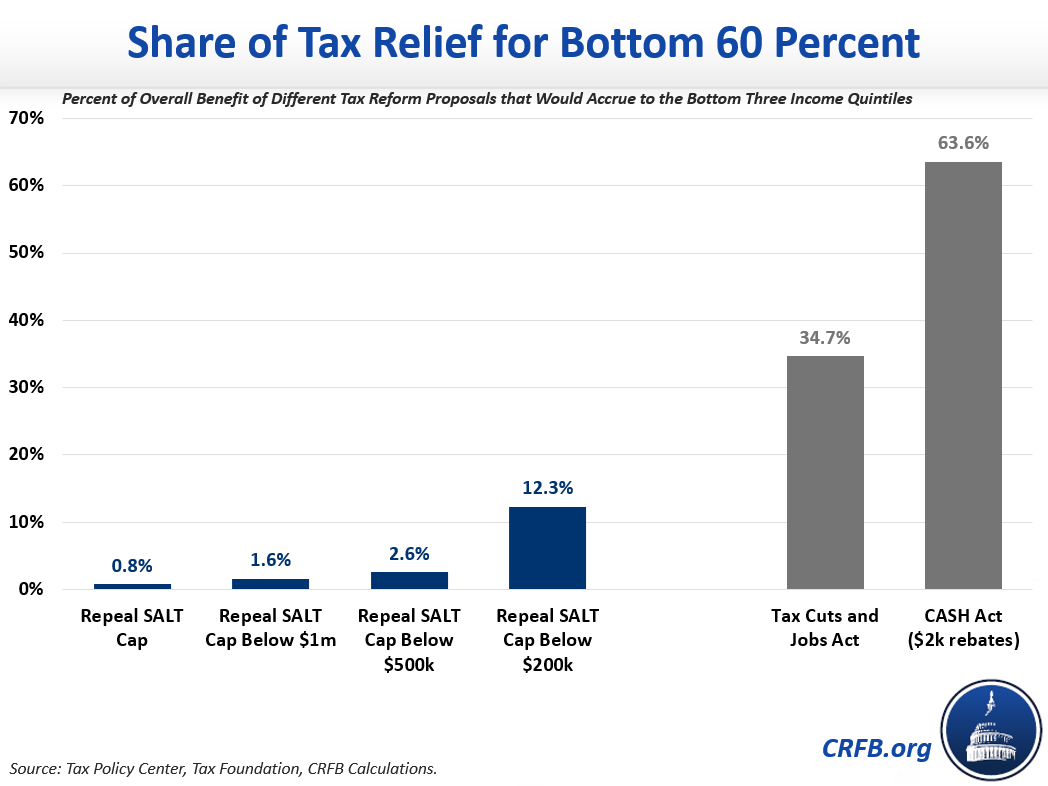

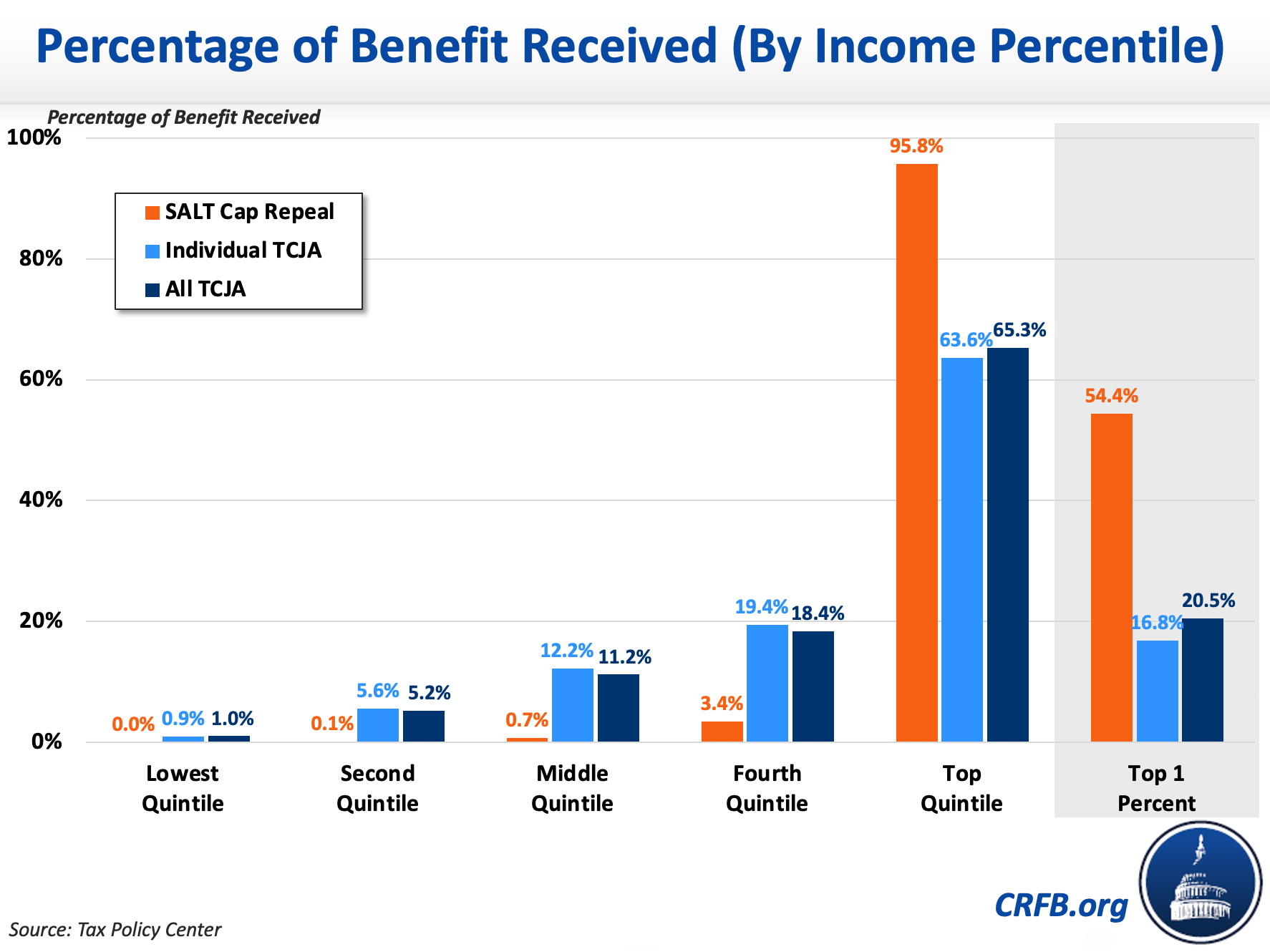

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Ny House Democrats Demand Repeal Of Salt Cap The Hill

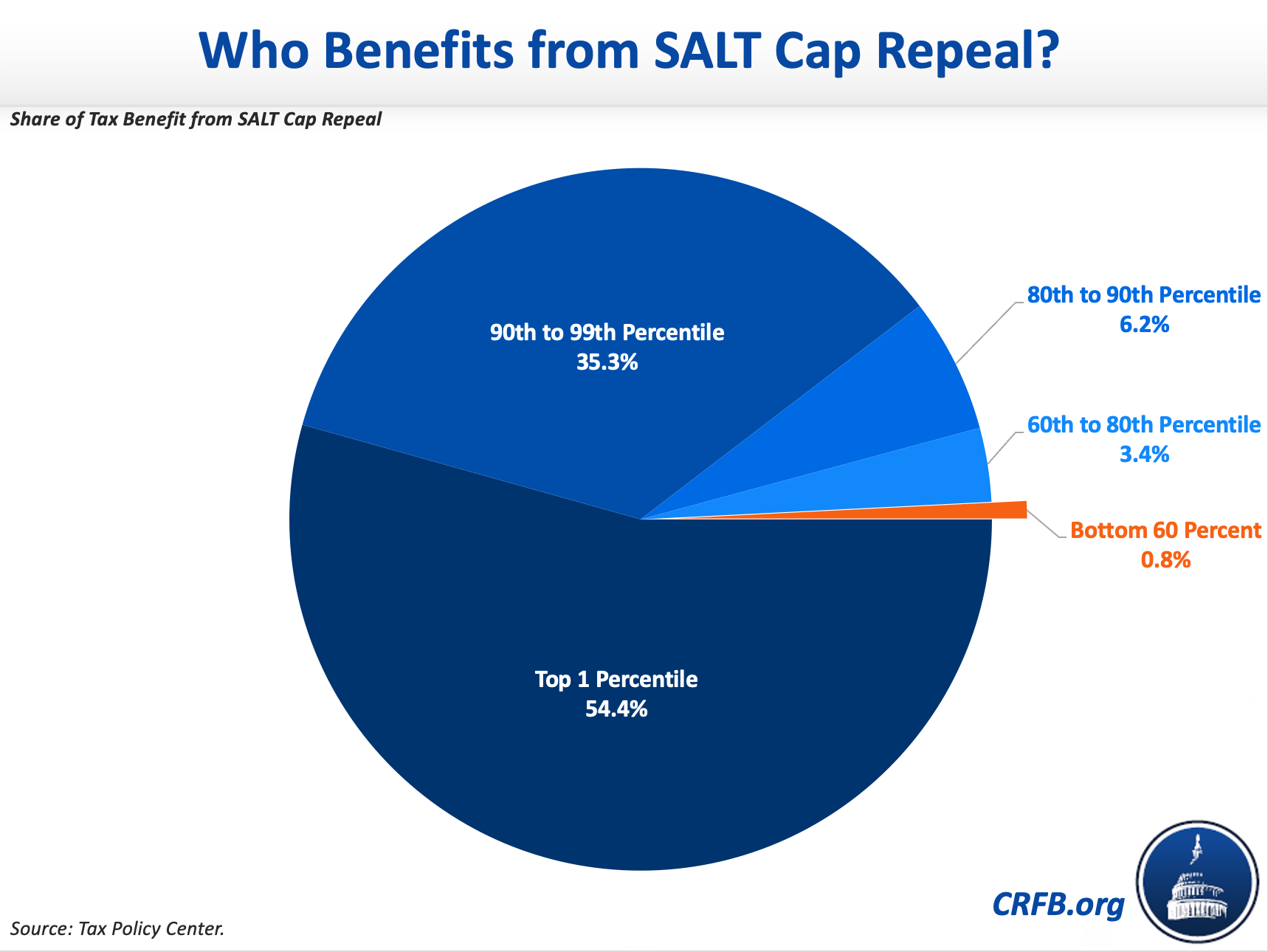

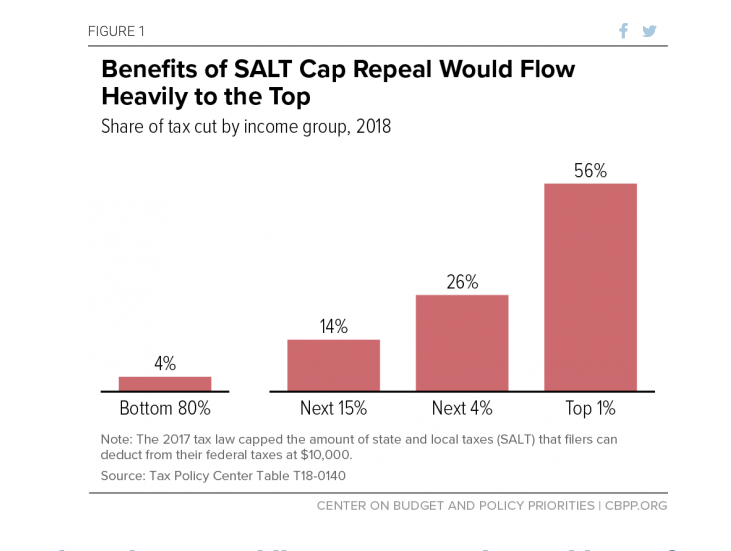

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

Letter Argument Against Salt Tax Repeal Misleading

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Salt Cap Repeal Disproportionately Favors Wealthy People R Neoliberal

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

The Heroic Congressional Fight To Save The Rich

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget